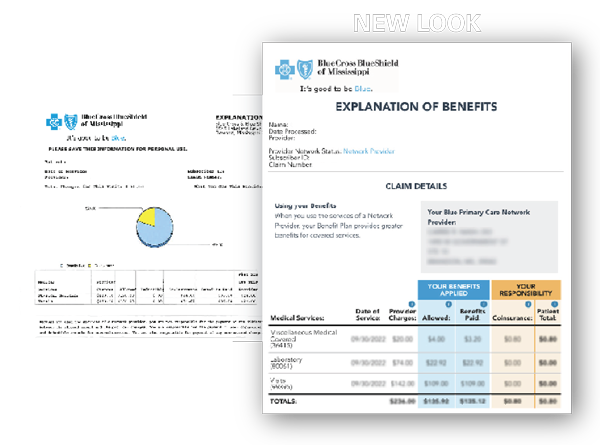

Your Explanation of Benefits

EOBs are a tool for showing you the value of Blue! You see the cost of the services you received and the savings BCBSMS helped you achieve. It has useful information that helps track your healthcare expenditures and serves as an explanation of the medical services you received.

The most important thing to remember is an EOB is not a bill. It is a document we provide you to let you know how your benefits have been applied to your healthcare services. It can help you understand how much your Provider charged for your care, what we (BCBSMS) paid, and what you may still owe for your service(s).

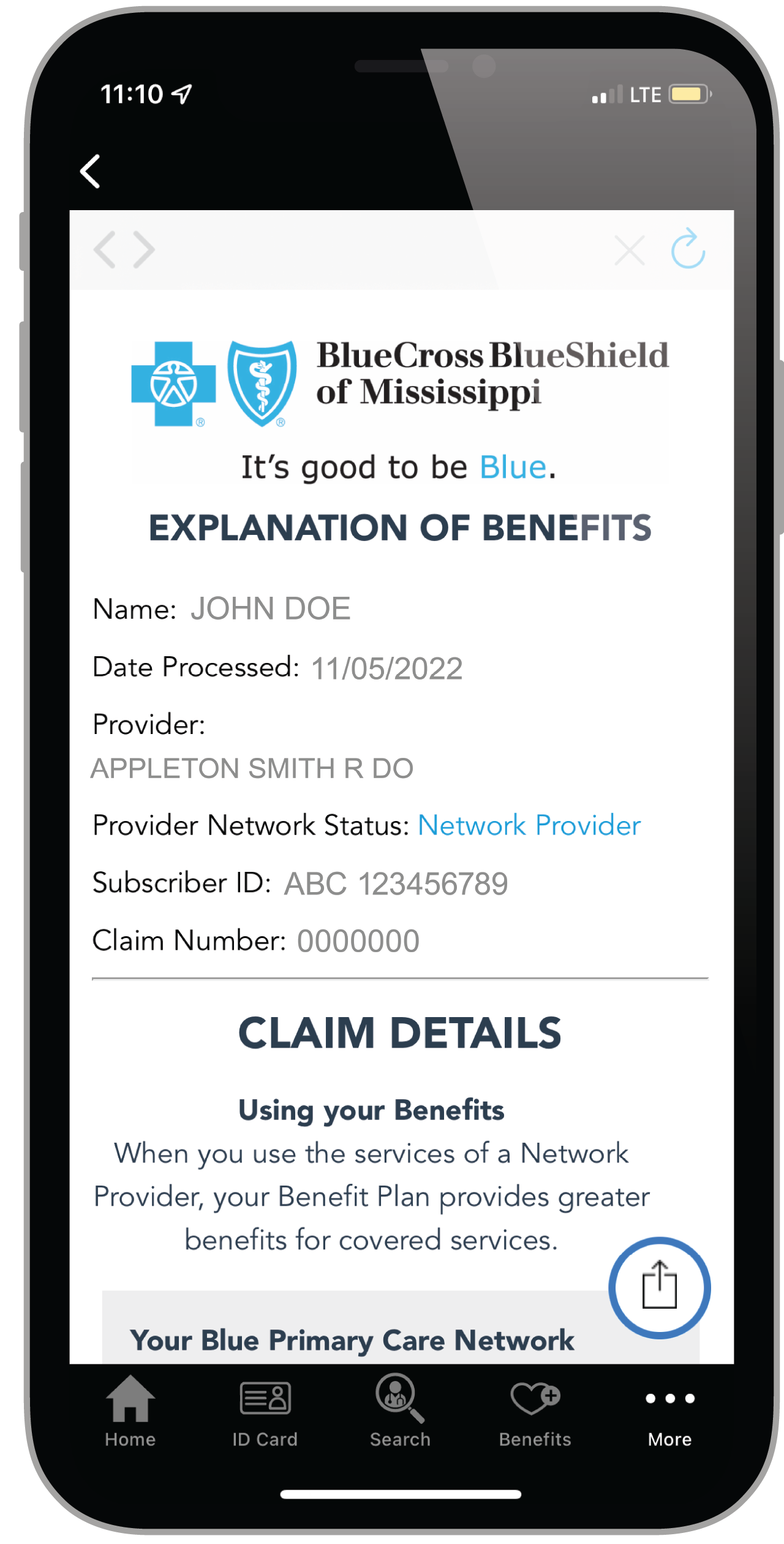

Reviewing your EOB in your myBlue mobile app

-

After logging in to your myBlue mobile app, select the “More” tab

-

Select “Claims”

-

Select the claim you would like to review

Important Terms to Know

After you use your health plan benefits, Blue Cross & Blue Shield of Mississippi will send you an Explanation of Benefits (EOB) through your myBlue app. Here are some helpful terms that are good to know.

-

Provider Charges

This is what the price would be without health insurance. It’s the total amount charged by a Provider for services you received.

-

Allowable

This is the lesser of the covered charges or the amount established by BCBSMS as the maximum amount for the Provider’s covered services. When billing for covered services, a Network Provider cannot bill you for an amount greater than this Allowable. This is why using a Network Provider is so important! If you use a Non-Network Provider, you may be responsible for paying for the full amount of Provider Charges.

-

Benefits Paid

The amount paid to your Network Provider by your Benefit Plan. Benefits are based on the Allowable minus any applicable Deductible, Coinsurance or Copay.

-

Deductible

This is the amount you pay for certain covered services before your benefits are available. Your Provider may bill you for this amount. The Deductible may be an Individual or a Family Deductible. Individual is met by one Member while Family is met by all covered Family Members together.

-

Coinsurance

The portion of the Allowable, calculated using a fixed percentage, you pay for certain covered services. For example: If we pay 80% of the Allowable, 20% of the Allowable would be your coinsurance.

-

Copay

This is the amount you are responsible for paying for a covered service. The amount is usually paid at the time of your appointment and can vary based on the type of service you are receiving or the type of Provider you are seeing.

-

Patient Total

Your share of the cost of services shown on the EOB. This includes any Deductible, Coinsurance or Copay amounts. If the Provider’s bill matches the amount you owe, simply pay the Provider.

Always Check Your EOBs

Your EOB is an important record of claims for services paid from your benefits. You need to carefully check your EOB. You want to be sure the services you received match the services you were billed for. If something looks wrong, call us at the number of your Virtual ID card, or your Provider’s office to ask about it.

Women's Health

Women's Health Eat Healthy

Eat Healthy Exercise

Exercise Health & Wellness Articles

Health & Wellness Articles